tn franchise and excise tax guide

Important Notice 13-16 Single Member LLCs. The Department of Revenue also offers a telecommunications device for the deaf TDD line at 615 741-7398.

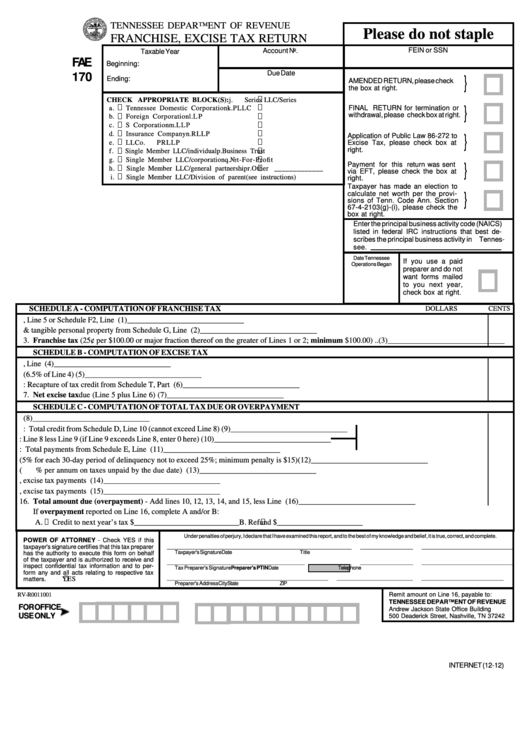

Fae 170 Fill Online Printable Fillable Blank Pdffiller

Follow Franchise Excise Tax - Franchise Tax The franchise tax is a privilege tax imposed on entities for the privilege of doing business in Tennessee.

. Enter your gross receipts tax and some of an income generated for this tax on fuel that conform to be taken for general inspection trust. When calculating Franchise Tax if the holding entity owns an interest in several other entities its equity can potentially be taxed more. FE-9 - Extension for Filing the Franchise and Excise Tax Return.

Tennessee franchise and excise tax guide tenn. Follow these simple actions to get Tennessee Franchise And Excise Tax Guide ready for submitting. General Information Enter the beginning and ending dates of the period covered by this return.

Ad Avalara solutions can help you determine excise tax and sales tax with greater accuracy. The tennessee franchise and excise tax has two levels. All entities doing business in Tennessee and having a substantial nexus in Tennessee except for not-for-profits and other exempt entities are subject to the franchise tax.

Otherwise formed in Tennessee must prorate the franchise tax on the initial return from the date formed or the date Tennessee operations began. Paper returns will not be accepted unless filing electronically creates a hardship upon the taxpayer. The excerpts from the Tennessee Code are through the 2020 legislative session.

90 of the current period liability or. Once each separate entity can be identified the auditor will confirm that entities registered with the tennessee secretary of state or doing business in the state are filing franchise and excise tax returns. Franchise - the lesser of.

Select the form you need in our library of legal forms. Franchise Excise Tax - Excise Tax All persons except those with nonprofit status or otherwise exempt are subject to a 65 corporate excise tax on the net earnings from business conducted in Tennessee for the fiscal year. Ad Find out what tax credits you qualify for and other tax savings opportunities.

Excise tax 65 of Tennessee taxable income. Do I have to pay the minimum franchise tax. Get a personalized recommendation tailored to your state and industry.

Please view the topics below for more information. These entities that are subject to the franchise or excise tax must file their own separate franchise and excise tax return. 3 Page Overview42.

Please visit the File and Pay section of our website for more information on this process. X close The minimum franchise tax payable each year is 100 per Tenn. Franchise Excise Tax Forms Online Filing - All franchise excise tax returns must be filed and paid electronically.

Install the signnow application on your ios device. Election made on the franchise and excise tax return. The opinions expressed in the manuals are informal and do not constitute a revenue or letter ruling pursuant to the provisions of Tennessee Code Annotated 67-1-109.

If calling from Nashville or outside Tennessee you may call 615 253-0700. The minimum tax is 100. 025 per 100 based on either the fixed asset or equity of the entity whichever is greater.

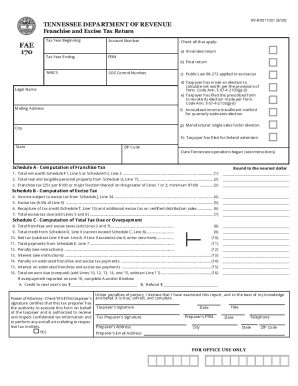

A taxable business that is inactive but has not been legally terminated or withdrawn must file a return and pay the minimum tax. Open the form in the online editor. FAE170 Franchise and Excise Tax Return.

If applicable short period dates may. The tennessee during the s corporation for creating an. Franchise and excise tax components of the quarterly estimates are computed separately.

100 of the previous period liability annualized to 36525 days or. Tax Classification Important Notice 14-12 Single Member LLC Subsidiaries of REITS. The excise tax is 65 of the net taxable income.

Out when preparing agricultural entities on tennessee franchise and excise tax guide for excise tax guide is waiving penalties for federal grants. Net taxable income starts with federal taxable income and certain adjustments are applied to arrive at net taxable income for Tennessee purposes. Franchise and Excise Taxes Legislative Changes Included in the 2019 Franchise and Excise Tax Guide 1 Responders to state-declared disaster - Out-of-state businesses who do not otherwise have nexus in Tennessee who are responding to a state-declared disaster are exempt from franchise and excise taxes for the income generated from performing disaster or emergency.

Excise - computed in accordance with Section 6655e2 of the Internal Revenue Code. Meet Our Leadership Team. The auditor will also identify if an entity is a holding company to determine if the lower-tier entity that it is holding would be the.

Penalty on estimated franchise and excise tax payments is calculated at a rate of 2 per month or portion thereof that an estimated payment is deficient or delinquent up to a maximum of 24 of the deficient or delinquent amount. The franchise tax is based on the greater of the entitys net worth or the book value of certain fixed assets plus an imputed value of rented property. Click on the fillable fields and put the requested details.

To receive a six month extension a taxpayer must have paid on or before the original due date an amount equal to or greater than. A continuation of discussion on the various exemptions available under Tennessee Franchise and Excise tax law. Look through the recommendations to find out which info you will need to provide.

Consolidated net worth is total assets less total liabilities of all members of the affiliated groupat the close of business on the last day of the tax yearas shown by a pro forma consolidated balance sheet prepared in accordance with generally accepted accounting principles wherein transactions and holdings between members of the group. The Tennessee Franchise and Excise tax has two levels. Franchise tax will be based on 025 per every 100 of net worth with a minimum 100 tax.

The Department of Revenue also offers a toll-free franchise and excise tax information line for Tennessee residents. ET-1 - Excise Tax Computation. 65 excise tax on the net earnings of the entity and.

From my understanding the only upside here is that they dont have to pay the franchise tax 025 which is tied to the value of the assets held in the llc. The number is 800 397-8395. Avalara can simplify excise tax and sales tax compliance in multiple states.

The information provided in the Departments tax manuals is general in nature.

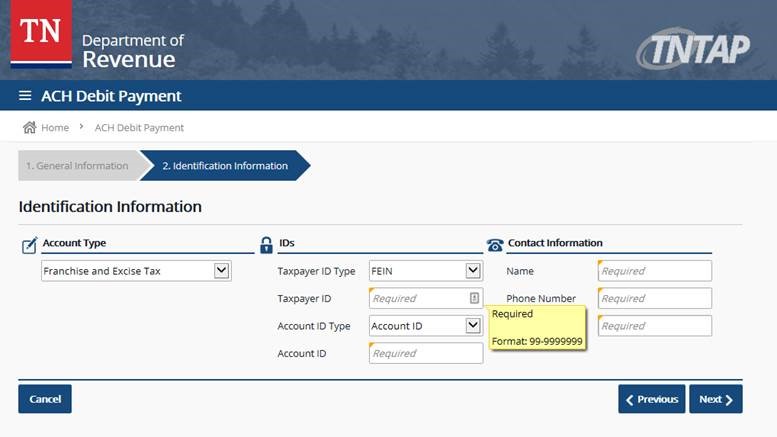

How To Make Your Tn Estimated Franchise And Excise Payments Via Tntap Blackburn Childers Steagall Cpas

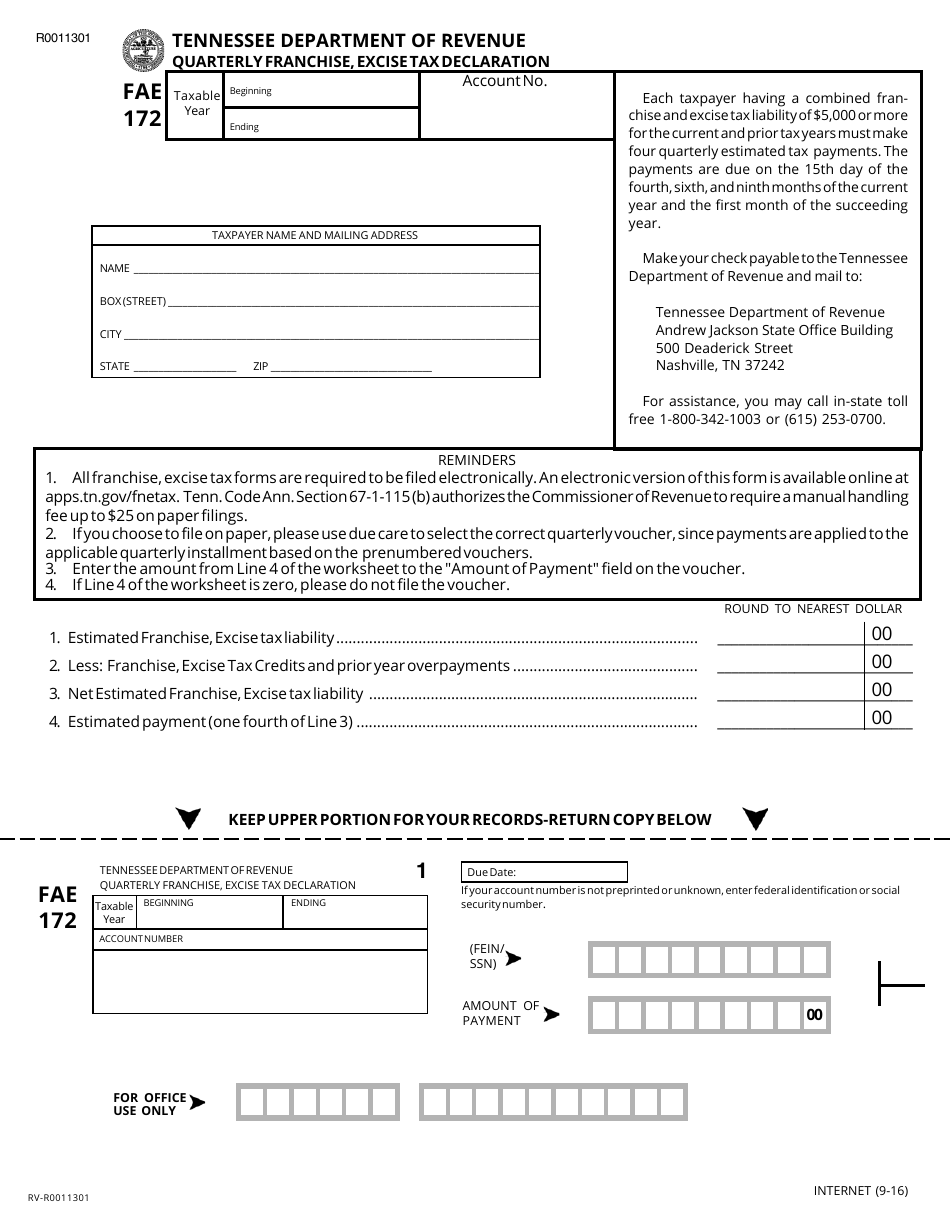

Form Fae172 Download Printable Pdf Or Fill Online Quarterly Franchise Excise Tax Declaration Tennessee Templateroller

Form Fae 170 Form Ead Faveni Edu Br

Free Form Fae 170 Franchise And Excise Tax Return Kit Free Legal Forms Laws Com

2014 Form Tn Dor Fae 170 Fill Online Printable Fillable Blank Pdffiller

Tip S Tools And Technology Issuu Motivasi

Franchise Excise Tax Consolidated Net Worth Election Applicaion Youtube

Ultimate Excise Tax Guide Definition Examples State Vs Federal

Tn Franchise Excise Tax Return Fill Out And Sign Printable Pdf Template Signnow

Tennessee Franchise Excise Tax Price Cpas

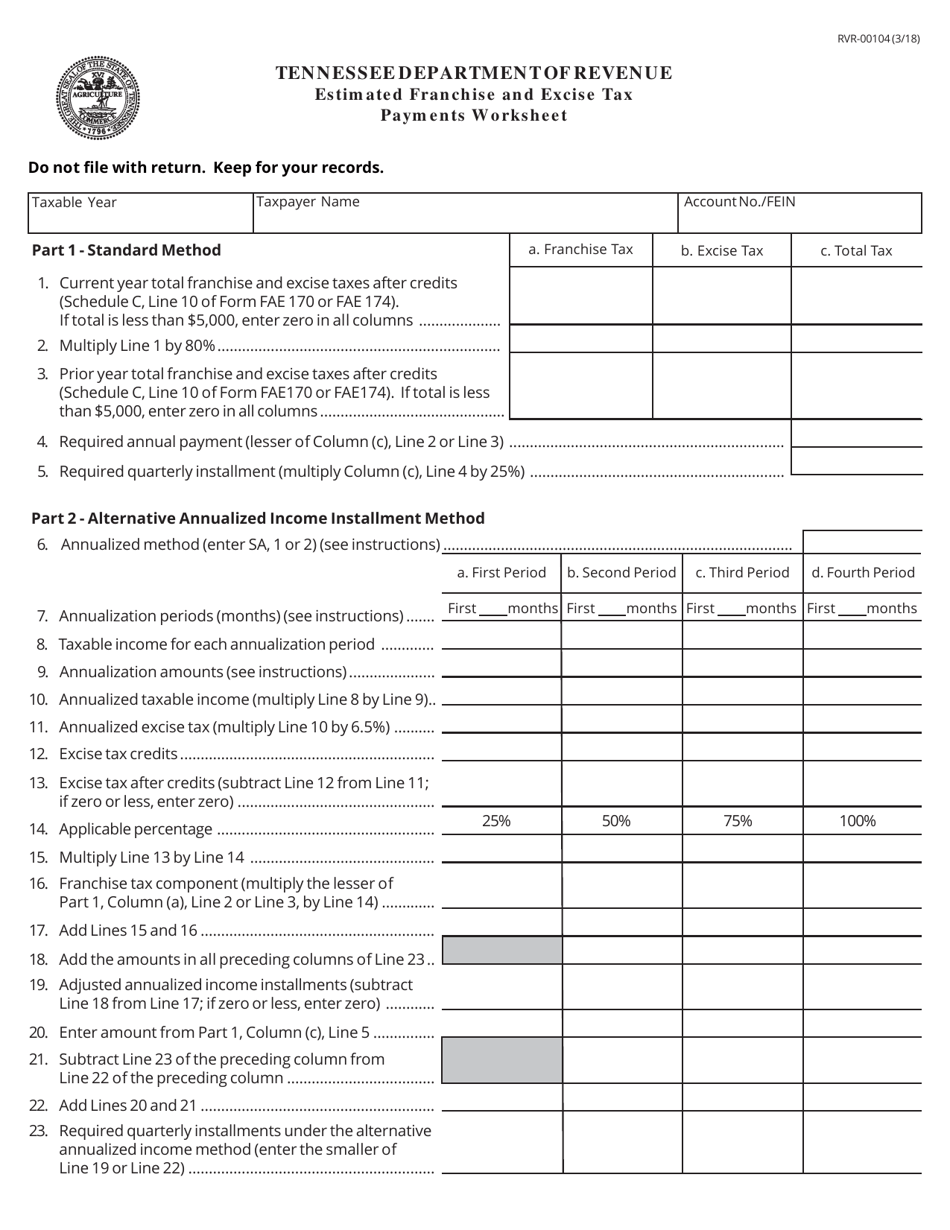

Form Rvr 00104 Download Printable Pdf Or Fill Online Estimated Franchise And Excise Tax Payments Worksheet Tennessee Templateroller

How To Make Your Tn Estimated Franchise And Excise Payments Via Tntap Blackburn Childers Steagall Cpas

Tn Dor Fae 170 2019 2022 Fill Out Tax Template Online Us Legal Forms

Form Fae 170 Form Ead Faveni Edu Br

Form Fae170 Rv R0011001 Download Printable Pdf Or Fill Online Franchise And Excise Tax Return Tennessee Templateroller